Question: What is Komatsu doing wrong?

Answer: Komatsu’s vulnerability in the face of Caterpillar is its weak foreign distribution.

Supporting Case Observations:

- Strong domestic distribution

- Most effective and efficient sales network in Japan (p. 10, ¶ 5)

- 1985: around 60% market share in Japan (p. 10, ¶ 5)

- Highly centralized production system

- “Economics of shipping heavy equipment around the world became a burden” (p. 11, ¶ 7)

- Having a centralized production system may not be attractive to less developed countries who want contracts that will promote jobs in their countries (p. 11, ¶ 7). Caterpillar has an advantage here because they have production facilities across the globe[1]

- It may make sense that Komatsu prefers a highly centralized system because Japan has a past of thousands of years of isolationism[2]; even if Kawai may be western-leaning, his management staff may not be.

- Developing foreign distribution

- Working with USSR

- Expected to overtake Caterpillar sales soon (p. 10, ¶ 6)

- The Siberian natural resources project bought tons of equipment (p. 10, ¶ 6)

- Because the United States and the USSR are having a Cold War at this point, this may be a spot where Komatsu can exploit the fact that Caterpillar is American and may not be able to trade with the USSR soon

- Marketing well-received in Australia (p. 10, ¶ 7)

- Very little production abroad due to highly centralized production (mentioned above)

- Only two assembly operations in foreign countries (Brazil and Mexico) (p. 11, ¶ 7).

- It would make sense to have manufacturing facilities in many countries, mostly in the Far East, due to growing sales in the region (Exhibit 4)

- In the future, it would be prudent of Komatsu to establish manufacturing facilities in the United States to compete head-to-head with Caterpillar and other American EME companies[3]

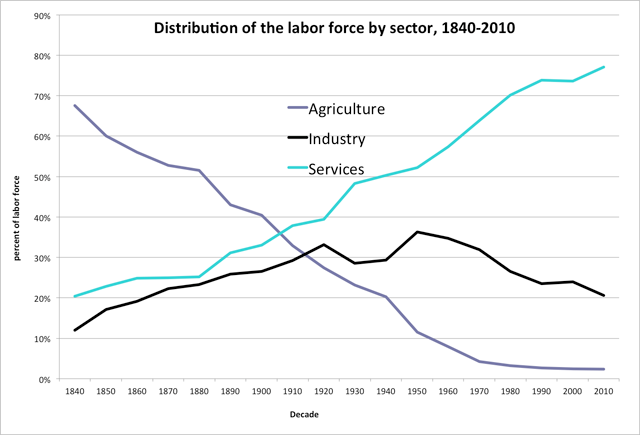

- As the services industry grows and the agriculture and manufacturing industries shrink, those with manufacturing skills are still available and not employed. [4]

- There is a large manufacturing labor pool in the United States; see Graph 1[5]

- If Komatsu were to use this local labor and then sell through local dealers, they could establish a stronger US customer base

- It is much cheaper to hire local labor in foreign countries to assemble machines than it is to build everything in Japan and then ship it

- Komatsu recognizes that they “have some gaps” in their overseas sales network. (p. 11, ¶ 5). Komatsu had a tiny market share in the United States, which led to poor dealership confidence in the ability to sell Komatsu equipment; Komatsu was unable to convince many dealers to sell their equipment (p. 4, ¶ 1)

- Working with USSR

Graph 1

Weaknesses

- Komatsu has started using a body-on-frame system[6] for producing different models built for different environments and applications. This makes production cheaper and faster, especially if they can find a way to produce several models on the same assembly line. This would help them expand their foreign distribution.

- Komatsu has good labor relations (p. 13, ¶ 2), which puts them at an advantage against Caterpillar in this aspect because Caterpillar had poor labor relations (they suffered from a 204-day strike that ended in May 1983) (p. 3, ¶ 2)

- Komatsu devotes around 5.8% of their sales to R&D department (p. 9, ¶ 7), and they focus on innovative technologies that put them ahead of the curve of the EME industry that could help shield them from Caterpillar’s backlash

- Komatsu management focused on detecting and responding to problems in the field[7], which would help them improve the quality of their equipment, therefore making the equipment more attractive to buyers.

[1] Caterpillar Case Study

[2] Tasca, Diane. U.S.-Japan Economic Relations: Cooperation, Competition, and Confrontation. Burlington: Elsevier Science, 2013. Print. https://books.google.com/books?id=AhuLBQAAQBAJ&lpg=PA3&ots=9f33RnPJ5u&dq=japanese%20isolationist%20culture&pg=PA3#v=onepage&q=japanese%20isolationist%20culture&f=false

[3] Komatsu Company History, http://www.komatsu.com/CompanyInfo/profile/outline/history.html#c04

[4] History Lessons: Understanding the decline in manufacturing, https://www.minnpost.com/macro-micro-minnesota/2012/02/history-lessons-understanding-decline-manufacturing

[5] Same source as footnote 4

[6] Clayton M. Christensen, The Past and Future of Competitive Advantage, http://media.wiley.com/product_data/excerpt/84/07879584/0787958484.pdf

[7] Hasegawa, Yozo and Kimm, Anthony. Japanese Business Leadership: 15 Japanese Managers and the Companies They’re Leading To New Growth